#1 What happens when my patient’s Personal Injury Protection (PIP) runs out?

QUESTION: What happens when my patient’s Personal Injury Protection (PIP) runs out?

ANSWER: If your patient’s PIP benefit becomes depleted, there may be additional PIP policies they can access. If on the day that the car accident occurred, and your patient had auto insurance for their own car, they have a secondary PIP policy they can make a claim against. Additionally, Oregon PIP statutes state that PIP coverage is available for any family member residing in the household, at the time of the collision. Your patient does not have to be named as an insured on the family member’s policy.

What happens when my patient’s Personal Injury Protection (PIP) coverage runs out?

You may be surprised to learn that there may be additional PIP policies your patient can access to cover their medical bills for their ongoing treatment. Knowing the right questions to ask your patient will help you to uncover if there are other PIP policies they can utilize — what we call, “Hidden PIP Benefits.”

Let’s look at an example of a situation where multiple PIP policies can be accessed.

If your patient is a passenger in a friend’s car and they’re involved in an accident, your patient will make a claim on the PIP policy that covers the car that they were in during the accident. But, what happens if the PIP coverage for that policy is exhausted?

If, on the day that the collision occurred, your patient had car insurance on their own car — they have a secondary PIP policy they can use.

Let’s say that the second PIP policy is also depleted and your patient still needs more medical treatment — there actually may be more PIP coverage for them. If on the day the car accident happened, your patient was living with a family member who had their own insurance policy, your patient may be able to tap into that policy as well.

The Oregon PIP statutes state that PIP coverage is available for any family member residing in the household, at the time of the auto accident. Your patient does not have to be named as an insured on the family member’s policy.

If your patient is living with a parent (brother, sister, cousin, etc) and that family member has an insurance policy, your patient can make a PIP claim on their policy.

In this example and set of circumstances, your patient would have actually had three separate PIP policies that could be accessed — one after the other. This situation doesn’t happen all the time, but it is possible and good to know about and keep in mind.

The way you can be of support to your patients is to know the right questions to ask to find hidden PIP policies. The more you know about the details and circumstances surrounding your patient’s car accident, the better position you’re in to have access to the benefits they’re entitled to to help them make the best recovery possible.

If you would like more information about the types of questions to ask your patient to know if there are additional PIP polices that can be utilized, please contact our office. We’re happy to help.

We’re here to be a bridge of support for you and your patients.

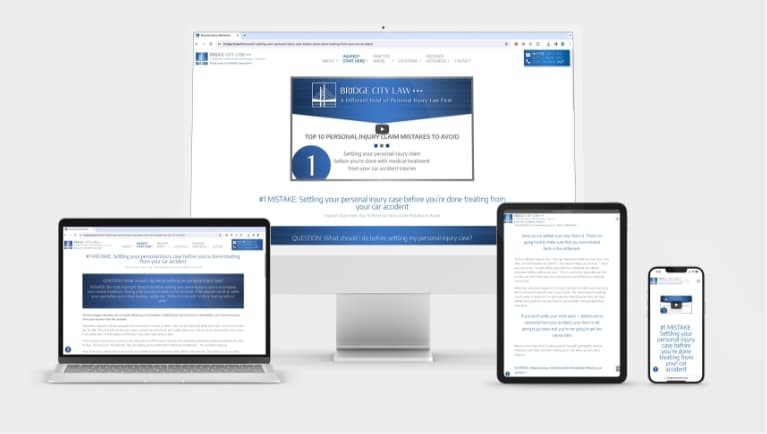

We have developed a robust library of information for your patients who have been injured in an accident, which can be found in the INJURED? START HERE portal on our website.

There are 40 topic-focused articles, with accompanying videos, organized into the four categories that include the personal injury claim-related questions we’re asked most often, which include:

- Top 10 Personal Injury Claim Mistakes to Avoid

- What You Need to Know About Your Claim

- How Are My Medical Bills & Wage Loss Paid

- How to Prepare for Your Independent Medical Exam

Each article provides advice and guidelines to help your patients navigate each phase of the personal injury claims process. Whether we represent your patient or not, we are passionate about them knowing how to protect their rights, get the medical care they need, and avoid the mistakes that can harm their personal injury claim.

Each article provides advice and guidelines to help your patients navigate each phase of the personal injury claims process. Whether we represent your patient or not, we are passionate about them knowing how to protect their rights, get the medical care they need, and avoid the mistakes that can harm their personal injury claim.

Additionally, if it would be helpful to have the information we feature on our website available in your office to pass along to your patients, we’ve developed brochures for each of the four article series -- in both English and Spanish that we’re happy to send to your office. Please complete the form below and we’ll get them out to you promptly.