Claims Against Insurance Company Attorneys

As a Portland, Oregon, personal injury law firm, we understand the challenges that come with fighting insurance companies for claims to be paid. Unfortunately, it is common for insurance carriers to engage in questionable tactics and even deceptive practices to avoid paying damages, leaving consumers feeling overwhelmed and unsure of their legal rights.

Quick Links

The role of insurance companies

Communicating with insurance companies

How do I advocate for my rights against insurance companies?

How do I challenge an unfair or insufficient claim payout?

Office of the insurance commissioner

Oregon’s consumer protection division

What happens if the insurance company refuses to pay my claim?

What are deceptive insurance practices?

Can I sue my insurance company?

Do insurance companies cross-check-claims?

What reports do Insurance companies use?

Contact our Oregon accident attorneys at Bridge City Law to schedule a free consultation

Our claims against insurance company attorneys at Bridge City Law have over three decades of experience in providing guidance on how to protect your rights and advocate for your claim against an insurance company to get the compensation you deserve.

Insurance policies are supposed to be a safety net for individuals that experience loss, but too often, we see that insurance companies are not willing to pay out claims as they should. If you or a loved one has been injured in an accident, and you are not getting cooperation from the insurance company, you may be entitled to compensation from the insurance company for your personal injury claim and an additional claim if they are acting in bad faith. Our attorneys can assist you with determining if you have a personal injury claim in Portland, Oregon, and how to file a claim against an insurance company.

The Role of Insurance Companies

Insurance companies are in the business of selling policies and collecting premiums. They are not in the business of paying out claims. While insurance companies have an obligation to their policyholders, they also have a responsibility to their shareholders to maximize profits. Unfortunately, this can sometimes lead to deceptive insurance practices, such as denying valid claims or delaying payment.

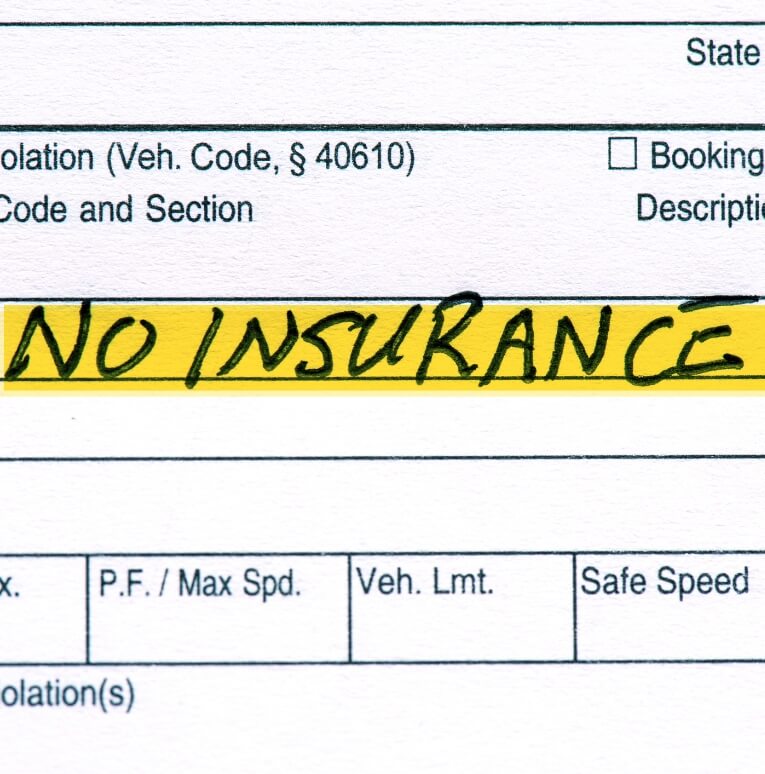

Types of Personal Injury Claims.

Personal injury claims arise from a variety of accidents, such as car accidents, trip-and-fall accidents, and wrongful death accidents. In Oregon, if you are injured due to the negligence of another party, you may be entitled to compensation for your damages. Damages can include medical bills, lost wages, pain and suffering, and other related expenses.

Filing a Claim.

If you have been injured in an accident, the first step is to seek medical attention right away. For the benefit of your claim, It is important to document your injuries and keep track of any expenses related to your injury. Next, you should contact the insurance company to file a claim. The insurance company will assign an adjuster to your case, who will investigate the accident and determine the value of your claim. Before speaking with the insurance company adjuster assigned to your claim, it is important to first consult with an experienced claim against insurance company attorney who is skilled and knowledgeable in personal injury law.

No charge Consultation

Contact us today and together we can figure out how we can be of service to you.

WE ARE AVAILABLE FOR VIDEO CONFERENCE CALLS

When You’ve Been Injured:

- We Are Available To You 24/7

- There is NO FEE OR OBLIGATION for An Initial Consultation

- You Don’t Pay a Fee Until We Successfully Settle Your Case

- We Are Experienced, Skilled, Responsive And Have Handled Thousands Of Cases

- We Take A Compassionate Approach To Personal Injury Law

- We Know How To Negotiate To Maximize Results

Communicating with Insurance Companies

It is important to remember that insurance companies are not on your side. They may try to deny or delay payment on your claim, even if it is valid.

With the guidance and advice of an attorney, it is important to provide as much documentation as possible to support your claim.

This can include medical records, police reports, and witness statements. It is also important to be honest and accurate when providing statements to insurance companies.

Any discrepancies in your statements can be used against you to deny your claim.

The legal professionals at Bridge City Law can advise you on exactly what to submit to the insurance companies and when the information and documentation should be shared.

If your claim is denied or you feel that the insurance company is not offering a fair settlement, you may need to take legal action. Our personal injury attorneys can help you determine if you have a claim and, if so, assist you in navigating the complex legal system and ensuring that your rights are protected, and you are treated fairly, even if that means fighting the insurance company.

HOW DO I ADVOCATE FOR MY RIGHTS

Against Insurance Companies?

Fighting against insurance companies requires a strategic approach that includes understanding the parameters and limits of the insurance policy, collecting evidence about your claim, and, ultimately, negotiating with the insurance carrier.

When you work with the legal professionals at Bridge City Law, we will help you evaluate your personal injury claim and your claim against the insurance company to determine if it is in your best interest to pursue legal action.

HOW DO I CHALLENGE

An Unfair Or Insufficient Claim Payout?

We guide our clients through the following steps when advocating for their rights and fighting against an unfair or insufficient insurance payout:

Understand your insurance policy: Before filing a claim, we’ll review your insurance policy to understand your coverage and any limitations to be aware of. We’ll note the time limits for filing a claim and the documentation your insurance company requires to support your claim.

Collect evidence: We’ll work with you to gather together the evidence that needs to be shared with the insurance company to support your claim. This may include photographs of the accident or damage, medical records, and witness statements.

File your claim: If you haven’t already done so, we’ll walk you through the steps to filing your personal injury claim with the insurance company and the documentation that needs to be included when filing.

Negotiate with the insurance company: When you work with the Bridge City Law claims against insurance company attorneys, we will take over all communication and negotiation with the insurance company and work strategically and diligently towards settling your claim.

File a lawsuit: If negotiation fails, filing a lawsuit against the insurance company may be your only option. If a lawsuit is necessary, we can represent you in seeking the damages for the amount owed under the policy, as well as any additional damages resulting from the insurer’s bad faith conduct.

office of the insurance commissioner

If an insurance company refuses to pay a claim, you have legal options. You may file a complaint with the Office of the Insurance Commissioner, which oversees insurance companies in the state of Oregon. The Office of the Insurance Commissioner may investigate the complaint and take action against the insurance company if it is found to have engaged in unfair or deceptive practices.

OREGON’S CONSUMER PROTECTION DIVISION

Additionally, the Consumer Protection Division of the Oregon Department of Justice provides resources and assistance to consumers who have been victims of deceptive insurance practices. If you believe that an insurance company has acted in bad faith, you can file a complaint with the Consumer Protection Division. The division will investigate the complaint and take appropriate action against the insurance company if necessary.

WHAT HAPPENS IF THE INSURANCE COMPANY

Refuses To Pay My Claim? Can I Sue An Insurance Company?

Yes, you can sue an insurance company if they have acted in bad faith or engaged in deceptive insurance practices.

Bad faith occurs when the insurance company denies a valid claim or fails to investigate the claim thoroughly.

Deceptive insurance practices may include false statements, misrepresentations, or other fraudulent activities that result in a denial of benefits.

In a lawsuit, you can seek damages for the amount owed under the policy, as well as any additional damages resulting from the insurer’s bad faith conduct.

We offer no-fee, no-obligation consultations

and can advise you if it is in your best interest

to file a lawsuit against an insurance company.

WHAT ARE DECEPTIVE INSURANCE PRACTICES?

Insurance companies may use a variety of deceptive practices to deny or delay payment on valid claims. Some common practices include:

- Misrepresenting policy terms and coverage

- Failing to investigate claims thoroughly

- Offering low-ball settlements

- Delaying payment on valid claims

- Refusing to pay claims without justification

Filing a claim against an insurance company for personal injury can be a complex and stressful process. However, with the help of our personal injury attorneys and resources, such as Oregon’s Consumer Protection Division and the Office of the Inspector General, we can advocate for your rights, fight back against deceptive insurance practices, and ensure that you receive fair compensation for your damages.

Remember to document your injuries and keep track of any expenses related to your injury. Before providing any statements to insurance companies, consult a skilled and knowledgeable personal injury attorney, and always be honest and accurate with the information you share about your claim.

If you believe that your insurance company has acted in bad faith or engaged in deceptive practices, or if you feel that your claim is being unjustly denied or delayed, with the right resources and support, we can help you fight for your rights and receive the compensation you deserve.

CAN I SUE MY INSURANCE COMPANY

For Emotional Distress?

Yes, you may be able to sue the insurance company for emotional distress if the insurer’s actions were particularly egregious or caused significant harm. Emotional distress claims can be difficult to prove, however, so it is important to consult with our personal injury attorneys to learn more about your legal options.

DO INSURANCE COMPANIES CROSS-CHECK CLAIMS

And Report Claims To Other Insurance Companies?

Yes, insurance companies do report claims to other insurance companies to ensure that the claimant does not receive duplicate benefits. For example, if you are involved in a car accident and have medical coverage through your car insurance policy, your insurance company may coordinate with your health insurance company to ensure that there is no overlap in coverage.

Insurance companies may also cross-check claims to verify the accuracy of the claim and to identify any potential fraud or misrepresentations.

DO INSURANCE CLAIMS FOLLOW YOU?

Insurance claims may follow you, depending on the type of claim and the insurance company’s policies. For example, if you file a claim for a car accident, the claim may be noted on your driving record and could impact your insurance rates.

WHAT REPORTS DO INSURANCE COMPANIES USE?

Insurance companies use a variety of reports to assess claims and calculate premiums. Some common reports used by insurance companies include:

Credit reports: Insurance companies may use credit reports to assess the risk of insuring a particular individual.

Medical reports: Insurance companies may use medical reports to assess the severity of injuries and the potential cost of treatment.

Police reports: Insurance companies may use police reports to assess liability in accidents and to verify the facts of the case.

Claims reports: Insurance companies may use claims reports to track previous claims filed by the claimant and to assess the risk of insuring the claimant.

THE LEGAL PROFESSIONALS AT BRIDGE CITY LAW

Have A Proven Track Record

Challenging an insurance claim payout and filing a claim against an insurance company can be a daunting and complicated process, but that should not discourage you from pursuing compensation for your damages.

Insurance companies may try to deny or delay payment on your claim, but you do have legal rights, and with the help of our Portland personal injury attorneys and resources such as Oregon’s Consumer Protection Division, you can challenge the insurance company and advocate for your rights.

The attorneys at Bridge City Law have been successfully negotiating with insurance companies and litigating cases in court when necessary for over 35 years. Our lawyers and legal team will review your case, provide legal advice, and develop a strategy to help you get the best possible outcome.

If you have been injured in an accident and suffered damages and are facing resistance from an insurance company, and you’re struggling to get your insurance claim paid, don’t give up. We can help you challenge deceptive insurance practices and protect your legal rights. Our compassionate and professional team is here to support you every step of the way.

Unsure if You Have a Case?

Contact us for a NO FEE Case Evaluation

"*" indicates required fields