#9 MISTAKE: The Downside to Billing Health Insurance

QUESTION: What is the downside to billing a patient’s health insurance for injuries due to a car accident?

ANSWER: Billing your patient’s health insurance for car accident injuries after their PIP benefits are exhausted can complicate their personal injury claim due to “Future Penalty Clauses.” These clauses restrict future medical treatment coverage after receiving a settlement. Before submitting your patient’s bills to their health insurance for payment, it’s critical to consider the impact on their long-term care and treatment, and to explore all options, including changing health insurance companies post-settlement, to avoid future coverage issues. Consulting with a personal injury attorney for advice on this matter is highly recommended and can be very valuable in determining the best strategy if your patient’s PIP benefits have been depleted.

Your patient billing their health insurance after their PIP coverage has been exhausted for treatment for injuries caused by a car accident is the ninth biggest mistake that can happen with your patient’s personal injury claim.

If your patient exhausts their PIP benefits, it makes sense to bill their health insurance company to cover their medical treatment for their injuries from their car accident. Unfortunately, this can create problems that will be detrimental to their personal injury claim.

One of the lesser-known problems with billing health insurance companies for car accidents (especially with Moda and Providence) is that their medical insurance policies include what is called “Future Penalty Clauses.”

What that means is If your patient’s health insurance pays for medical treatment related to their car accident, once your patient has received a settlement and the health insurance company has been reimbursed, the insurance company will not pay for future medical treatment related to the car accident.

Let’s say, your patient has a neck injury, PIP has been exhausted, and their health insurance policy covers a total of 12 visits a year — and the insurance company pays for those visits. After the claim settles and the insurance company is paid back for the bills they paid — they’re not going to pay for any future medical treatment — until they have proof that your patient has spent all the settlement money they received on their medical care.

If your patient has exhausted their PIP and they’re close to being done with their treatments — because you’re providing care for injuries from an accident that your patient was not at fault for — there are a number of factors to consider and it may be best not to bill your patient’s health insurance.

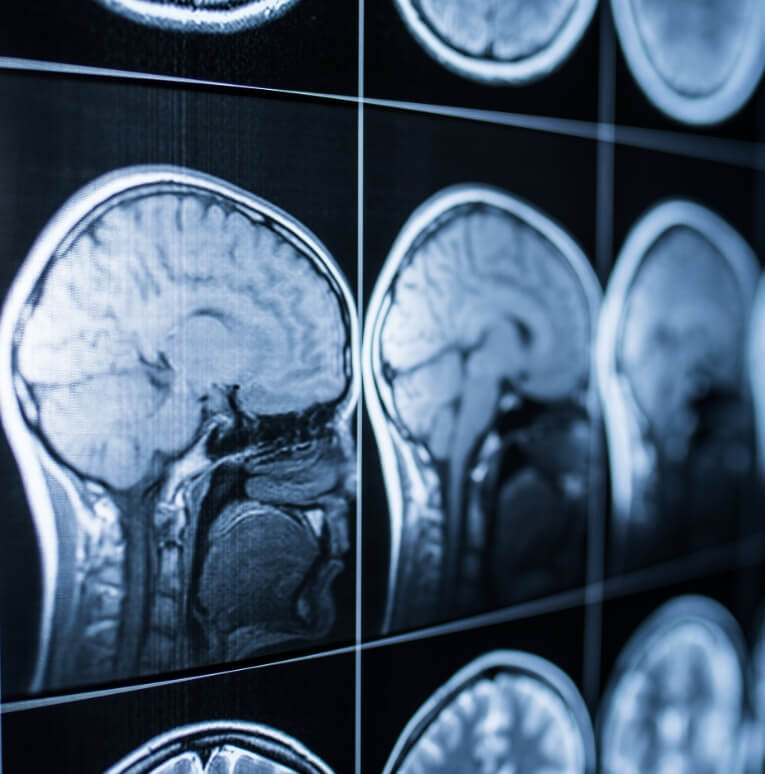

Clearly, the more treatment your patient needs for a full recovery, the more it may make sense to bill health insurance. For example, if they need surgery, MRI, or other diagnostic testing, billing health insurance will likely be necessary.

We often tragically joke “how do people with health insurance afford to get medical care?” Most health insurance policies don’t cover chiropractic care, massage therapy, or Acupuncture treatment. The policies that do, typically only cover 12 visits in a year — and there has to be a pre-authorization for the treatment. This means it’s likely that the health insurance company is only going to authorize paying for a fraction of your actual costs.

There is a way for your patient to get around the future penalty clause.

If they’re able to change health insurance companies after the settlement of their claim, the penalty clause will not apply.

Not everyone has this option. But if it is possible, it’s good to know there is a workaround.

If you have any questions about billing your patient’s health insurance for car accident-related injuries, consider talking with a personal injury attorney who can evaluate these complex dynamics and give the appropriate advice to help protect your patient.

We’re here to be a bridge of support for you and your patients.

We have developed a robust library of information for your patients who have been injured in an accident, which can be found in the INJURED? START HERE portal on our website.

There are 40 topic-focused articles, with accompanying videos, organized into the four categories that include the personal injury claim-related questions we’re asked most often, which include:

- Top 10 Personal Injury Claim Mistakes to Avoid

- What You Need to Know About Your Claim

- How Are My Medical Bills & Wage Loss Paid

- How to Prepare for Your Independent Medical Exam

Each article provides advice and guidelines to help your patients navigate each phase of the personal injury claims process. Whether we represent your patient or not, we are passionate about them knowing how to protect their rights, get the medical care they need, and avoid the mistakes that can harm their personal injury claim.

Each article provides advice and guidelines to help your patients navigate each phase of the personal injury claims process. Whether we represent your patient or not, we are passionate about them knowing how to protect their rights, get the medical care they need, and avoid the mistakes that can harm their personal injury claim.

Additionally, if it would be helpful to have the information we feature on our website available in your office to pass along to your patients, we’ve developed brochures for each of the four article series -- in both English and Spanish that we’re happy to send to your office. Please complete the form below and we’ll get them out to you promptly.

![[FOR MEDICAL PROVIDERS] #9 The Downside to Billing Health Insurance](https://www.bridgecitylawfirm.com/wp-content/plugins/wp-youtube-lyte/lyteCache.php?origThumbUrl=https%3A%2F%2Fi.ytimg.com%2Fvi%2FCIjos4i500Y%2F0.jpg)